Bank Of America Check Deposit

Learn the procedure to follow when depositing mobile checks at Bank of America. This article will also include check depositing limits and the time taken to process mobile check deposits. If you also wish to know how to cancel mobile check deposits, continue reading this article.

Contents

- How to deposit a check online at Bank of America

- Mobile check deposit Bank of America FAQs

How to deposit a check online at Bank of America

Many branches are open on Saturday to take deposits from clients. That being said they are entered into the system but do not process until Monday night after midnight want to go in through proof which verifies the transaction internally before it.

The Bank of America is one of the most accepted and used banks in the USA. Just like the other financial institutions, this bank has also attained a great deal and moved its services into the digital world.

Paperless Deposits. Bank of America has been part of the trend to shift to paperless deposits. These deposits allow customers to drop a check in the ATM without an envelope. Instead, the ATM reads the information from the check, and the customer's receipt includes an image of the check. A perfect bank deposit stamp! This self inking stamp is ideal for rapid, repetitive stamping because the die automatically re-inks itself by rotating into a self-contained, double-sided ink pad. Ordinary ink pads offer a certain number of impressions before they begin to fade. Bank of America Third-Party Check Cashing Policy. Bank of America will cash or deposit a third-party check in some cases, but not all. A third-party check is one that has been made payable “to the order of X,” where X is another person designated by the original payee. There are strict regulations for cashing or depositing a third-party.

Now you can deposit your check online from your destination; it can be at home, school, or workstations, without physically visiting the bank or its ATMs.

The process for depositing your check at this bank through the online method is indeed easier. Just follow the following few steps and you will be done in less than 30 minutes.

Step 1: Confirm that you have a strong internet connection

This is an important step. With strong internet connectivity, you are likely to spend less time depositing your check online.

Kindly, if you find that you find you have slow internet connections, use another option of depositing your check such as visiting the bank or move to a nearby cyber for strong internet connection.

Step 2: Confirm that your check is not fake

Confirmation of the genuineness of your check is the second most important step. It lowers the possibility of your check being rejected.

Step 3: Download the Bank of America official application

The app is available online at Google Play Store. Just download it or if you have it, go to the next step.

Step 4: Sign in to access your checking account or savings account

In case you find it difficult logging in, you can request for help from the Bank of America customer care team.

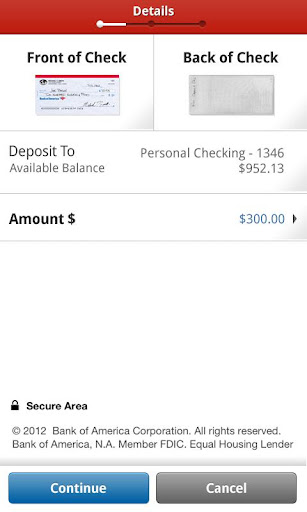

Step 5: Take a picture of your check

When taking the picture, make sure that you capture all the important details such as the amount and endorsement area.

Step 6: Upload your check

To upload your check is easier because there are steps and guidelines throughout the app, which are meant to guide you. Once you have uploaded the check, ensure the details you have entered are correct and submit your check for processing.

Step 7: Completion of depositing

You will receive a notification, once you are done. If it’s unsuccessful, you are requested to try again after rectifying the issue that could have led to the rejection of your check.

How long does Mobile check at BoA take?

Depositing a check through the BoA app usually takes twenty to thirty minutes. After this period, you will receive notification that your check has been accepted or not.

If it has been accepted, you are likely to see your money in your account after a maximum of fifteen days. The period depends on the number of clients who are using the application.

BoA mobile check deposit time

If you have a strong internet connection, you are likely to spend less than 20 minutes to have your depositing process done. However, if your internet is slow, you may take a little bit longer.

BoA Mobile check deposit Limit

The mobile check deposit feature of this bank has some deposit limits, depending on the client’s time with the financial institution, and the type of your account.

Those with an account that has been active for less than 90 days are allowed to deposit 1,000 dollars a month. But, for those whose account has been operational for over three months, they can deposit up to 5,000 dollars in a single month.

Cancel Mobile Check deposit at Bank of America

As an esteemed client, you are given a chance to request the cancellation of your mobile check deposit. However, when requesting a cancellation, you are expected to give the reason why you are doing so.

After that, you will wait for a notification that your check deposit has been successfully canceled. For more details, kindly contact the customer care team.

Mobile check deposit Bank of America FAQs

There are several questions that individuals do ask themselves pertaining to the Bank of America. Nevertheless, the following is the most commonly asked questions that you will ever find in almost all platforms and forums.

Mobile check deposit BoA not working – what should I do?

In certain instances, you will find that the mobile checking deposit not to work. Usually, when there a massive system failure, clients are informed through their emails or texts. Again, if there is a planned maintenance program, you will be notified.

However, if you do not receive any notification and you experience a system failure, you are advised first to check your internet connection.

If the connection is strong, you should contact the customer care team to receive further instructions on what to do.

References on BoA Mobile check deposit

- Bank of America: How to use Mobile Check Deposit for Fast & Simple Deposits

- LendEDU: Can you cancel a check?

READ MORE: Banks with Mobile check deposit

If you bank at Bank of America, never make an ATM deposit there, especially if the money’s coming from another bank. Here’s why…

I’m a Bank of America account-holder, which is to say I’ve also been a Bank of America hostage.

Bank Of America Check Deposit Slip

For the last week, Bank of America has held a $2,080 deposit of mine — written by my business partner off her account with another bank — as “delayed.” For a week. For seven days, Bank of America customer service agents either wouldn’t or couldn’t explain why I could not access money that was properly deposited and is MY money.

Until last night.

After I raised a stink on social media (which is a #WiseStrategy you should read about here), a very professional BofA social media agent reached out. She explained to me that because I deposited the check via an ATM inside my neighborhood Bank of America branch and because the check was an unusual amount ($2,080? Not exactly a fortune) written from another bank’s account, it triggered a 7-day delay in making the funds available.

Well, that triggered me — not only because my own bank was holding my money hostage, but also because my bank may have violated federal law.

According to BankRate.com, federal regulations require that local funds deposited via an ATM must be made available no later than the second business day after the deposit, as long as the check was deposited on a banking day (mine was a non-holiday Monday), and the check was deposited in an ATM owned by the depositor’s bank (it was). Non-local checks can be held for five business days, but not a day longer.

As if she were doing me a favor, the BofA social media agent proudly announced she would release my funds to me, even though BofA sent me a notice that it intended to delay the deposit as long as eightbusiness days — again, in violation of federal regulations according to BankRate.com.

Of course, I have neither the time nor the money to sue Bank of America. But I do have my blog and the bully pulpit of Wise Choices…and I will soon be taking my banking elsewhere.

Just so you know, here’s BankRate.com’s summary of federal regulations regarding the availability of deposited funds:

- Banks must post or provide a notice at each ATM location that funds deposited in the ATM may not be available for immediate withdrawal.

- If a bank makes funds from deposits at an ATM it doesn’t own available for withdrawal later than funds from deposits at an ATM it does own, it must provide a description of how the customer can tell the difference between the two ATMs.

- If you deposit money in an ATM that isn’t owned by your bank, the funds must be available for withdrawal not later than the fifth business day following the banking day on which the funds are deposited.

- Funds deposited at an ATM that is not on or within 50 feet of the premises of the bank are considered deposited on the day funds are removed from the ATM, if funds are not normally removed from the ATM more than two times each week.

- A bank that operates an off-premises ATM from which deposits are not removed more than two times each week must disclose at or on the ATM the days on which deposits made at the ATM will be considered received.

- Funds deposited at a staffed facility, ATM or contractual branch are considered deposited when they are received at the staffed facility, ATM or contractual branch.

Bank Of America Check Deposit Machine

Copyright 2018 Wise Choices TM. All rights reserved.