Cd Account

Online-only in the U.S., Barclays doesn't offer a checking account but has strong interest rates on its savings and CD accounts. Spencer Tierney July 30, 2020 Many or all of the products featured. Jan 22, 2021 See the latest certificate of deposit rates and offers from Chase Bank. SmartAsset's experts give a brief overview of each CD account, including their current rates, minimum balance and fees. See if opening up a CD account today is right for you.

The Certificate of Deposit (CD) Calculator can help determine accumulated interest earnings on CDs over time. Included are considerations for tax and inflation for more accurate results.

Results

|

What is a Certificate of Deposit?

A certificate of deposit is an agreement to deposit money for a fixed period that will pay interest. Common term lengths range from three months to five years. The lengthier the term, the higher the exposure to interest rate risk. Generally, the larger the initial deposit, or the longer the investment period, the higher the interest rate. As a type of investment, CDs fall on the low-risk, low-return end of the spectrum. Historically, interest rates of CDs tend to be higher than rates of savings accounts and money markets, but lower than the historical average return rate of equities. There are also different types of CDs with varying rates of interest, or rates linked to indexes of various kinds, but the calculator can only do calculations based on fixed rate CDs.

The gains from CDs are taxable as income in the US unless they are in accounts that are tax-deferred or tax-free, such as an IRA or Roth IRA. For more information about or to do calculations involving a traditional IRA or Roth IRA, please visit the IRA Calculator or Roth IRA Calculator.

CDs are called 'certificates of deposit' because before electronic transfers were invented, buyers of CDs were issued certificates in exchange for their deposits as a way for financial institutions to keep track of buyers of their CDs. Receiving actual certificates for making deposits is no longer practiced today, as transactions are done electronically.

FDIC-Backed

One of the defining characteristics of CDs in the US is that they are protected by the Federal Deposit Insurance Corporation (FDIC). CDs that originate from FDIC-insured banks are insured for up to $250,000, meaning that if banks fail, up to $250,000 of each depositors' funds is guaranteed to be safe. Anyone who wishes to deposit more than the $250,000 limit and wants all of it to be FDIC-insured can simply buy CDs from other FDIC-insured banks. Due to this insurance, there are few lower risk investments. Similarly, credit unions are covered by insurance from the National Credit Union Administration (NCUA insurance), which provides essentially the same insurance coverage on deposits as the FDIC.

Where and How to Purchase CDs

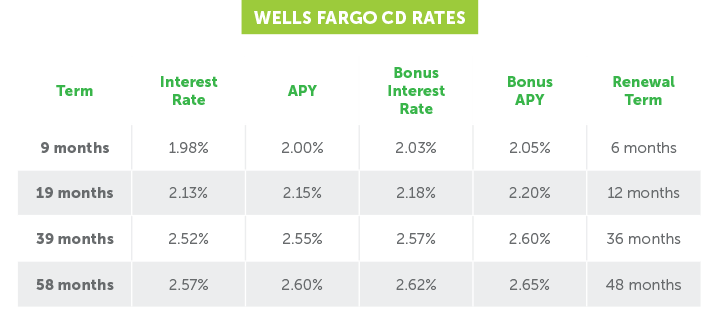

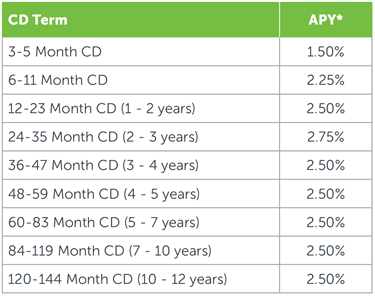

CDs are typically offered by many financial institutions (including the largest banks) as fixed income investments. Different banks offer different interest rates on CDs, so it is important to first shop around and compare maturity periods of CDs, especially their annual percentage yields (APY). This ultimately determines how much interest is received. The process of buying CDs is straightforward; an initial deposit will be required, along with the desired term. CDs tend to have various minimum deposit requirements. Brokers can also charge fees for CDs purchased through them.

'Buying' a CD is effectively lending money to the seller of the CD. Financial institutions use the funds from sold CDs to re-lend (and profit from the difference), hold in their reserves, spend for their operations, or take care of other miscellaneous expenses. Along with the federal funds rate, all of these factors play a part in determining the interest rates that each financial institution will pay on their CDs.

History of CDs

Although they weren't called CDs then, a financial concept similar to that of a modern CD was first used by European banks in the 1600s. These banks gave a receipt to account holders for the funds they deposited, which they lent to merchants. However, to ensure that account holders did not withdraw their funds while they were lent out, the banks began to pay interest for the use of their money for a designated period of time. This sort of financial transaction is essentially how a modern CD operates.

A major turning point for CDs happened in the early twentieth century after the stock market crash of 1929, which was partly due to unregulated banks that didn't have reserve requirements. In response, the FDIC was established to regulate banks and give investors (such as CD holders) assurance that the government would protect their assets up to a limit.

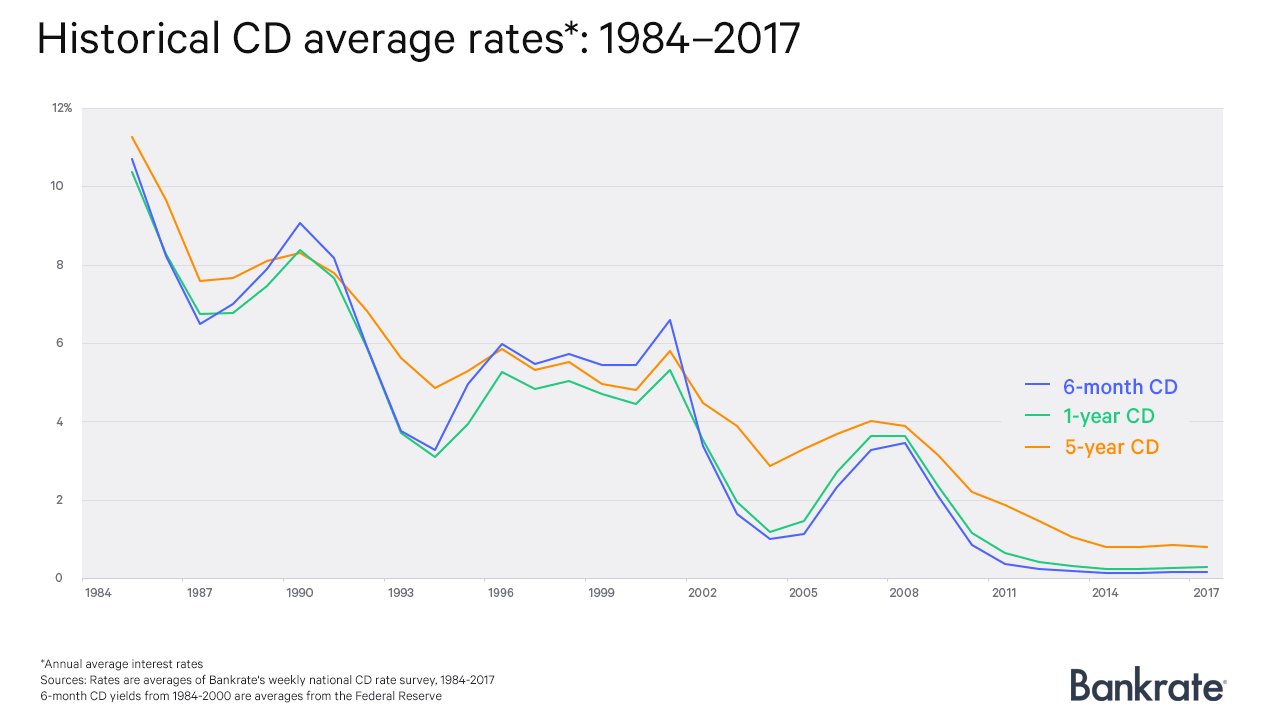

Historically, rates of CD yields have varied greatly. During the high-inflation years of the late 1970s and 1980s, CDs had return rates of almost 20%. On the other hand, CD rates have dropped to as low as standard savings rates during certain years. CD rates have declined since 1984, a time when they once exceeded 10% APY. In late 2007, just before the economy spiraled downward, they were at 4%. In comparison, the average one-year CD yield is around 0.4% in 2017. In the US, the Federal Reserve, which controls federal funds rate, calibrates them accordingly based on the economic climate.

Certificate Of Deposits

How to Use CDs

CDs are effective financial instruments when it comes to protecting savings, building short term wealth, and ensuring returns without risk. With these key benefits in mind, it is possible to capitalize on CDs by using them to:

- supplement diversified portfolios to reduce total risk exposure. This can come in handy as retirees get closer to their retirement date and require a more guaranteed return to ensure they have savings in retirement to live off of.

- act as a short term (5 years or less) place to put extra money that isn't needed or isn't required until a set future date. This can come in handy when saving for a down payment for a home or car several years in the future.

- estimate future returns accurately because most CDs have fixed rates. The result of this is a useful investment for people who prefer predictability.

As the maturity date for a CD approaches, CD owners have options of what to do next. In most cases, if nothing is done, after maturity date the funds will likely be reinvested into another similar CD. If not, it is possible for buyers to notify the sellers to transfer the funds into a checking or savings account, or reinvest into a different CD.

Withdrawing from a CD

Funds that are invested in CDs are meant to be tied up for the life of the certificate, and any early withdrawals are normally subject to a penalty (except liquid CDs). The severity of the penalty depends on the length of the CD and the issuing institution. As an aside, in certain rising interest rate environments, it can be financially beneficial to pay the early withdrawal penalty in order to reinvest the proceeds into new higher yielding CDs.

CD Ladder

While longer-term CDs offer higher returns, an obvious drawback to them is that the funds are locked up for longer. A CD ladder is a common strategy employed by investors that attempts to circumvent this drawback by using multiple CDs. Instead of renewing just one CD with a specific amount, the CD is split up into multiple amounts for multiple CDs in a set up that allows them to mature at staggered intervals. For example, instead of investing all funds into a 3-year CD, the funds are used to invest in 3 different CDs at the same time with terms of 1, 2, and 3 years. As one matures, making principal and earnings available, proceeds can be optionally reinvested into a new CD or withdrawal. CD laddering can be beneficial when more flexibility is required, by giving a person access to previously-invested funds at more frequent intervals, or the ability to purchase new CDs at higher rates if interest rates go up.

APY vs APR

It is important to make the distinction between annual percentage yield (APY) and annual percentage rate (APR). Banks tend to use APR for debt-related accounts such as mortgages, credit cards, and car loans, whereas APY is often related to interest-accruing accounts such as CDs and money market investments. APY denotes the amount of interest earned with compound interest accounted for in an entire year, while APR is the annualized representation of monthly interest rate. APY is typically the more accurate representation of effective net gains or losses, and CDs are often advertised in APY rates.

Compounding Frequency

The calculator contains options for different compounding frequencies. As a rule of thumb, the more frequently compounding occurs, the greater the return. To understand the differences between compounding frequencies or to do calculations involving them, please use our Compound Interest Calculator.

Types of CDs

- Traditional CD—Investors receive fixed interest rates over a specified period of time. Money can only be withdrawn without penalty after maturity, and there are also options to roll earnings over for more terms. Traditional CDs that require initial deposits of $100,000 or more are often referred to as 'jumbo' CDs, and usually have higher interest rates.

- Bump-Up CD—Investors are allowed to 'bump up' preexisting interest rates on CDs to match higher current market rates. Bump-up CDs offer the best returns for investors who hold them while interest rates increase. Compared to traditional CDs, these generally receive lower rates.

- Liquid CD—Investors can withdraw from liquid CDs without penalties, but they require maintaining a minimum balance. Interest rates are relatively lower than other types of CDs, but for the most part, still higher than savings accounts or money market investments.

- Zero-Coupon CD—Similar to zero-coupon bonds, these CDs contain no interest payments. Rather, they are reinvested in order to earn more interest. Zero-coupon CDs are bought at fractions of their par values (face value, or amount received at maturity), and generally have longer terms compared to traditional CDs, which can expose investors to considerable risk.

- Callable CD—Issuers that sell callable CDs can possibly recall them from their investors after call-protection periods expire and before they mature, resulting in the return of the initial deposit and any subsequent interest earnings. To make up for this, sellers offer higher rates for these CDs than other types.

- Brokered CD—These are different in that they are sold in brokerage accounts, and not through financial institutions such as banks or credit unions. An advantage to brokered CDs is that there is exposure to a wide variety of CDs instead of just the CDs offered by individual banks.

Alternatives to CDs

- Paying Off Debt—Especially for high-interest debt, paying off existing debt is a great alternative to CDs because it is essentially a guaranteed rate of return, compared to any further investment. Comparatively, even the interest rate of a low rate loan, such as home mortgage, is normally higher than CDs, making it financially rewarding to payoff loan than to collect interest from CD.

- Money Market Accounts—Investors who like the security of a CD and are okay with slightly lower returns can consider money market accounts, which are certain types of FDIC-insured savings accounts that have restrictions such as limits on how funds can be withdrawn. They are generally offered by banks.

- Bonds—Similar to CDs, bonds are relatively low risk financial instruments. Bonds are sold by government (municipal, state, or federal) or corporate entities.

- Peer-to-Peer Lending—Peer-to-peer (P2P) lending is a fairly new form of lending that arose from advances in internet technology that enables lenders and borrowers to link up on an online platform. Peer borrowers request loans through the platform, and lenders can fund the loans they find desirable. Each P2P lending service will come with rules in order to regulate cases of default.

- Bundled Mortgages—Commonly available through mutual funds, bundled mortgages are securities that are traded in a similar manner as bonds, but generally yield more than Treasury securities. Although they received a lot of negative publicity for the role they played in the 2008 financial crisis, mortgage securities have bounced back through more stringent regulations. Bundled mortgages are backed by the Government National Mortgage Association (Ginnie Mae).

A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions. CDs differ from savings accounts in that the CD has a specific, fixed term (often one, three, or six months, or one to five years) and usually, a fixed interest rate. The bank expects CD to be held until maturity, at which time they can be withdrawn and interest paid.

Like savings accounts, CDs are insured 'money in the bank' (in the US up to $250,000) and thus, up to the local insured deposit limit, virtually risk free. In the US, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions.

In exchange for the customer depositing the money for an agreed term, institutions usually offer higher interest rates than they do on accounts that customers can withdraw from on demand—though this may not be the case in an inverted yield curve situation. Fixed rates are common, but some institutions offer CDs with various forms of variable rates. For example, in mid-2004, interest rates were expected to rise—and many banks and credit unions began to offer CDs with a 'bump-up' feature. These allow for a single readjustment of the interest rate, at a time of the consumer's choosing, during the term of the CD. Sometimes, financial institutions introduce CDs indexed to the stock market, bond market, or other indices.

Some features of CDs are:

- A larger principal should/may receive a higher interest rate.

- A longer term usually earns a higher interest rate, except in the case of an inverted yield curve (e.g., preceding a recession).

- Smaller institutions tend to offer higher interest rates than larger ones.

- Personal CD accounts generally receive higher interest rates than business CD accounts.

- Banks and credit unions that are not insured by the FDIC or NCUA generally offer higher interest rates.

Cd Account Citibank

CDs typically require a minimum deposit, and may offer higher rates for larger deposits. The best rates are generally offered on 'Jumbo CDs' with minimum deposits of $100,000. Jumbo CDs are commonly bought by large institutional investors, such as banks and pension funds, that are interested in low-risk and stable investment options. Jumbo CDs are also known as negotiable certificates of deposits and come in bearer form. These work like conventional certificate of deposits that lock in the principal amount for a set timeframe and are payable upon maturity. [1]

The consumer who opens a CD may receive a paper certificate, but it is now common for a CD to consist simply of a book entry and an item shown in the consumer's periodic bank statements. That is, there is often no 'certificate' as such. Consumers who want a hard copy that verifies their CD purchase may request a paper statement from the bank, or print out their own from the financial institution's online banking service.

Closing a CD[edit]

Withdrawals before maturity are usually subject to a substantial penalty. For a five-year CD, this is often the loss of up to twelve months' interest. These penalties ensure that it is generally not in a holder's best interest to withdraw the money before maturity—unless the holder has another investment with significantly higher return or has a serious need for the money.

Commonly, institutions mail a notice to the CD holder shortly before the CD matures requesting directions. The notice usually offers the choice of withdrawing the principal and accumulated interest or 'rolling it over' (depositing it into a new CD). Generally, a 'window' is allowed after maturity where the CD holder can cash in the CD without penalty. In the absence of such directions, it is common for the institution to roll over the CD automatically, once again tying up the money for a period of time (though the CD holder may be able to specify at the time the CD is opened not to roll over the CD).

CD refinance[edit]

The Truth in Savings Regulation DD requires that insured CDs state, at time of account opening, the penalty for early withdrawal. It is generally accepted that these penalties cannot be revised by the depository prior to maturity.[citation needed] However, there have been cases in which a credit union modified its early withdrawal penalty and made it retroactive on existing accounts.[2] The second occurrence happened when Main Street Bank of Texas closed a group of CDs early without full payment of interest. The bank claimed the disclosures allowed them to do so.[3]

The penalty for early withdrawal deters depositors from taking advantage of subsequent better investment opportunities during the term of the CD. In rising interest rate environments, the penalty may be insufficient to discourage depositors from redeeming their deposit and reinvesting the proceeds after paying the applicable early withdrawal penalty. Added interest from the new higher yielding CD may more than offset the cost of the early withdrawal penalty.

Ladders[edit]

While longer investment terms yield higher interest rates, longer terms also may result in a loss of opportunity to lock in higher interest rates in a rising-rate economy. A common mitigation strategy for this opportunity cost is the 'CD ladder' strategy. In the ladder strategies, the investor distributes the deposits over a period of several years with the goal of having all one's money deposited at the longest term (and therefore the higher rate) but in a way that part of it matures annually. In this way, the depositor reaps the benefits of the longest-term rates while retaining the option to re-invest or withdraw the money in shorter-term intervals.

For example, an investor beginning a three-year ladder strategy starts by depositing equal amounts of money each into a 3-year CD, 2-year CD, and 1-year CD. From that point on, a CD reaches maturity every year, at which time the investor can re-invest at a 3-year term. After two years of this cycle, the investor has all money deposited at a three-year rate, yet have one-third of the deposits mature every year (which the investor can then reinvest, augment, or withdraw).

The responsibility for maintaining the ladder falls on the depositor, not the financial institution. Because the ladder does not depend on the financial institution, depositors are free to distribute a ladder strategy across more than one bank. This can be advantageous, as smaller banks may not offer the longer terms of some larger banks. Although laddering is most common with CDs, investors may use this strategy on any time deposit account with similar terms.

Step-up callable CD[edit]

Step-Up Callable CDs are a form of CD where the interest rate increases multiple times prior to maturity of the CD. These CDs are often issued with maturities up to 15 years, with a step-up in interest happening at year 5 and year 10.[4]

Typically, the beginning interest rate is higher than what is available on shorter-maturity CDs, and the rate increases with each step-up period.

These CDs have a “call” feature which allows the issuer to return the deposit to the investor after a specified period of time, which is usually at least a year. When the CD is called, the investor is given back their deposit and they will no longer receive any future interest payments.[5]

Because of the call feature, interest rate risk is borne by the investor, rather than the issuer. This transfer of risk allows Step-Up Callable CDs to offer a higher interest rate than currently available from non-callable CDs. If prevailing interest rates decline, the issuer will call the CD and re-issue debt at a lower interest rate. If the CD is called before maturity, the investor is faced with reinvestment risk. If prevailing interest rates increase, the issuer will allow the CD to go to maturity.[6]

Deposit insurance[edit]

The amount of insurance coverage varies, depending on how accounts for an individual or family are structured at the institution. The level of insurance is governed by complex FDIC and NCUA rules, available in FDIC and NCUA booklets or online. The standard insurance coverage is currently $250,000 per owner or depositor for single accounts or $250,000 per co-owner for joint accounts.

Some institutions use a private insurance company instead of, or in addition to, the federally backed FDIC or NCUA deposit insurance. Institutions often stop using private supplemental insurance when they find that few customers have a high enough balance level to justify the additional cost. The Certificate of Deposit Account Registry Service program lets investors keep up to $50 million invested in CDs managed through one bank with full FDIC insurance.[7] However rates will likely not be the highest available.

Terms and conditions[edit]

There are many variations in the terms and conditions for CDs

The federally required 'Truth in Savings' booklet, or other disclosure document that gives the terms of the CD, must be made available before the purchase. Employees of the institution are generally not familiar with this information[citation needed]; only the written document carries legal weight. If the original issuing institution has merged with another institution, or if the CD is closed early by the purchaser, or there is some other issue, the purchaser will need to refer to the terms and conditions document to ensure that the withdrawal is processed following the original terms of the contract.

- The terms and conditions may be changeable. They may contain language such as 'We can add to, delete or make any other changes ('Changes') we want to these Terms at any time.'[8]

- The CD may be callable. The terms may state that the bank or credit union can close the CD before the term ends.

- Payment of interest. Interest may be paid out as it is accrued or it may accumulate in the CD.

- Interest calculation. The CD may start earning interest from the date of deposit or from the start of the next month or quarter.

- Right to delay withdrawals. Institutions generally have the right to delay withdrawals for a specified period to stop a bank run.

- Withdrawal of principal. May be at the discretion of the financial institution. Withdrawal of principal below a certain minimum—or any withdrawal of principal at all—may require closure of the entire CD. A US Individual Retirement Account CD may allow withdrawal of IRA Required Minimum Distributions without a withdrawal penalty.

- Withdrawal of interest. May be limited to the most recent interest payment or allow for withdrawal of accumulated total interest since the CD was opened. Interest may be calculated to date of withdrawal or through the end of the last month or last quarter.

- Penalty for early withdrawal. May be measured in months of interest, may be calculated to be equal to the institution's current cost of replacing the money, or may use another formula. May or may not reduce the principal—for example, if principal is withdrawn three months after opening a CD with a six-month penalty.

- Fees. A fee may be specified for withdrawal or closure or for providing a certified check.

- Automatic renewal. The institution may or may not commit to sending a notice before automatic rollover at CD maturity. The institution may specify a grace period before automatically rolling over the CD to a new CD at maturity. Some banks have been known to renew at rates lower than that of the original CD.[9]

Criticism[edit]

There may be some correlation between CD interest rates and inflation. For example, in one situation interest rates might be 15% and inflation 15%, and in another situation interest rates might be 2% and inflation may be 2%. Of course, these factors cancel out, so the real interest rate, which indicates the maintenance or otherwise of value, is the same in these two examples.

However the real rates of return offered by CDs, as with other fixed interest instruments, can vary a lot. For example, during a credit crunch banks are in dire need of funds, and CD interest rate increases may not track inflation.[10]

The above does not include taxes.[11] When taxes are considered, the higher-rate situation above is worse, with a lower (more negative) real return, although the before-tax real rates of return are identical. The after-inflation, after-tax return is what is important.

Author Ric Edelman writes: 'You don't make any money in bank accounts (in real economic terms), simply because you're not supposed to.'[12] On the other hand, he says, bank accounts and CDs are fine for holding cash for a short amount of time.

Cd Account Bank Of America

Even to the extent that CD rates are correlated with inflation, this can only be the expected inflation at the time the CD is bought. The actual inflation will be lower or higher. Locking in the interest rate for a long term may be bad (if inflation goes up) or good (if inflation goes down). For example, in the 1970s, inflation increased higher than it had been, and this was not fully reflected in interest rates. This is particularly important for longer-term notes, where the interest rate is locked in for some time. This gave rise to amusing nicknames for CDs.[Example?] A little later, the opposite happened, and inflation declined.

In general, and in common with other fixed interest investments, the economic value of a CD rises when market interest rates fall, and vice versa.

Some banks pay lower than average rates, while others pay higher rates.[13] In the United States, depositors can take advantage of the best FDIC-insured rates without increasing their risk.[14]

As with other types of investment, investors should be suspicious of a CD offering an unusually high rate of return. For example Allen Stanford used fraudulent CDs with high rates to lure people into his Ponzi scheme.

References[edit]

- ^Feldler, Alex (2017-06-13). 'The Best Jumbo CD Accounts of 2020'. MyBankTracker. Retrieved 2020-02-07.

- ^'Fort Knox FCU – Early Withdrawal Penalty'. DepositAccounts.

- ^'Main Street Bank closes CDs early'. JCDI. 2010-12-30.

- ^'Callable Step-Up Certificates of Deposit Wells Fargo Bank, N.A. Disclosure Statement'(PDF). 2015-10-01. Archived from the original(PDF) on 2017-12-01. Retrieved 2017-11-22.

- ^'What Are Callable Certificates of Deposit (CDs)?'. Do It Right. Retrieved 2017-11-22.

- ^'A word of caution regarding 'Step-Up Callable CDs''. Financial Strength Coach. Retrieved 2017-11-22.

- ^'CDARS'.

- ^'ING Direct Account Disclosures'. Archived from the original on 2012-02-09. Retrieved 31 Jan 2012.

Change to/Waiver of Terms: We can add to, delete or make any other changes ('Changes') we want to these terms at any time. You and your account will be bound by the Changes as soon as we implement them. If the Change isn't in your favor, before it's implemented, we'll let you know about it as required by law. However, if applicable law requires us to make a Change, you may not receive any prior notice. We can cancel, change or add products, accounts or services whenever we want. Notice of any such changes, additions or terminations will be provided as required by law. We can waive any of our rights under these Terms whenever we want, but this doesn't mean that we'll waive the same rights in the future.

- ^'Major Bank Certificate of Deposit Renewal Rate Rip-Off'. Archived from the original on 2008-07-03.

- ^Goldwasser, Joan (September 10, 2008). 'Upside of the Credit Crunch'. The Washington Post. Retrieved April 28, 2010.

- ^Ric Edelman, The Truth About Money, 3rd ed., p. 30

- ^Ric Edelman, The Truth About Money, 3rd ed., p. 61

- ^Compare a typical large-bank 1-year CD, e.g., 'Wells Fargo'. vs the highest 1-year CD available at a listing service, e.g., 'BankCD.com'.

- ^'FDIC: Insuring Your Deposits'. Archived from the original on 2008-09-16.

External links[edit]

- 2008 US SEC Litigation Release '...a scheme to defraud investors, many of them elderly, of approximately $3,661,248 by selling the investors fraudulent certificates of deposit.'