Chime Mobile Deposit

At the retail location, ask the cashier to make a deposit to your Chime Spending Account. You can make up to 3 deposits every 24 hours. You can add up to $1,000.00 every 24. Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Chime offers mobile check deposit to members who receive payroll direct deposits over $200 a month. Thirty days after you receive your payroll direct deposit, mobile check depositing will be automatically enabled in your Chime. Didn’t believe other posts about delayed deposits. Thought it was just a employer/payroll delay issue. For 3 years chime has always been on point. But chime is definitely fucking up. Have my check split in 2 accounts. Always have gotten chime deposit.

A new way to build credit

Increase your credit score by an average of 30 points² with our new secured credit card

Time from sent till received: Instant. As we covered in our guide to adding money to.

No annual fee or interest

No credit check to apply

No minimum security deposit required³

No fees or surprises

We’re here to help you break free from fees, annual interest, and large security deposits

No credit check to apply

Everyone deserves a fair shot at good credit, so we don’t check your score when you apply

Make every purchase count

Whether it’s gas or groceries, now everyday purchases can count toward building credit

Safer credit building

Turn on Safer Credit Building and your balance will be automatically paid on time, every month. We’ll keep the major credit bureaus updated.⁴

Join more than 1.5 million members already using Credit Builder

Available for Chime Spending Account holders with eligible direct deposit¹

Apply NowAlready a Chime member? Learn how to sign up for Credit Builder

See what our members are saying

“This card has changed my credit score for the good and I love it”

'My fiancé and I wants to buy a house...It(Credit Builder) is slowly but surely moving me and my family closer to our dreams.'

'I'm new to credit so it feels really good seeing that I'm safely increasing my score.'

Chime Mobile Check Deposit Limits

Questions?

Here’s everything you need to know about our Credit Builder

Before Applying

All you need is a Chime Spending Account and direct deposits of $200 or more within the past 365 days.

Don’t have a Chime Spending Account? Apply for one in under two minutes!

No way! We think everyone deserves a chance to build credit, so we don’t check your credit score when you apply.

Do I need to have a Chime Spending Account to use Credit Builder?

Yes. We designed Credit Builder to work with the Chime Spending Account so that you can move money instantly—across your Chime accounts!

Does Chime charge any fees for using Credit Builder?

Nope! We do not charge fees; no annual fees, maintenance fees, international fees, and no interest.

Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build on-time payment history, increase the length of your credit history over time, and more. We report to the major credit bureaus – TransUnion®, Experian®, and Equifax®.

Learn more about crediting building with Credit Builder.

What makes Credit Builder different from traditional credit cards?

Unlike traditional credit cards, Credit Builder helps you build credit with no fees and no interest. There’s also no credit check to apply!

Credit Builder is a secured credit card. The money you move into Credit Builder’s secured account is the amount you can spend on the card. Unlike other secured credit cards, that money can be used to pay off your monthly balances. Since Credit Builder doesn’t have a pre-set limit, spending up to the amount you added won’t contribute to a high-utilization record on your credit history.

Learn more about how Credit Builder works.

Yes, Credit Builder is a secured credit card. The money you move to the Credit Builder secured account is how much you can spend with the card. This amount is often referred to by other secured credit cards as the security deposit. Like other secured credit cards, Credit Builder also reports to the major credit bureaus, to help you build credit history over time.

However, for most secured credit cards, security deposits are unavailable to you, the consumer, until you close the account. With Credit Builder, you can use your deposit to pay for monthly charges. Plus, Credit Builder charges no fees and no interest, and no minimum security deposit required!

Yes, Credit Builder reports to the 3 major credit bureaus—TransUnion®, Experian® and Equifax®

Credit Builder doesn’t have a pre-set credit limit. Instead, the money you move into your Credit Builder secured account sets your spending limit on the card.

With traditional credit cards, using a high percentage of your available credit limit could negatively impact your credit score. You don’t have to worry about that with Credit Builder because Chime does not report credit utilization.

How much you can spend with Credit Builder is shown to you as Available to Spend in the Chime app.

If I use all the money I add into Credit Builder, will Credit Builder report high utilization and hurt my credit score?

Nope. Credit Builder doesn’t report percent utilization to the major credit bureaus because it has no pre-set credit limit. That means spending up to the amount you added will not show a high-utilization card on your credit history. So rest assured to use Credit Builder for your everyday purchases and let them count towards credit building!

Chime Mobile Deposit Limit

New member basics

How long does it take for my Credit Builder card to arrive?

After you enroll, it’ll take on average 5-7 business days for your Credit Builder card to arrive.

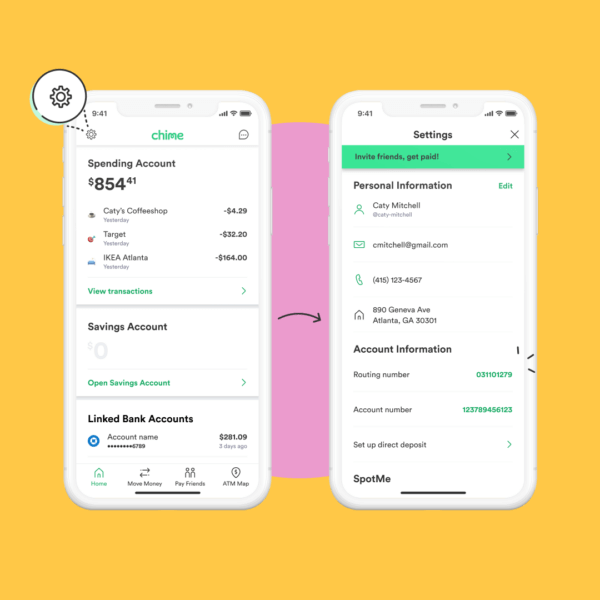

It’s easy! Just go to the Chime app > Settings > Credit Builder > Activate Card.

You can use the Credit Builder card anywhere Visa® credit cards are accepted.

It is an account that holds the money you’ve moved to Credit Builder. This money determines the amount you can spend with your Credit Builder card (a.k.a credit limit). You get to set your own limit by moving any amount to and from your Credit Builder secured account whenever you want.

When you make a purchase, a hold is placed on that money you just spent in your secured account. You can use this money later, to pay your monthly balance. Your Available to Spend will also go down. This way, you know how much more you can spend with your Credit Builder card.

Your Available to Spend is the money you’ve moved to your Credit Builder secured account minus the amount you’ve charged on your Credit Builder card. Move money from your Chime Spending Account into Credit Builder to increase Available to Spend any time!

Can I move money into my Credit Builder secured account from another bank?

No, you cannot move money from other banks to your Credit Builder secured account. You can only do that from your Chime Spending Account.

How long does it take to move money between my Credit Builder secured account and Spending Account?

Moving money between Chime Spending Account and Credit Buildertakes ~60 seconds! Once the transfer is complete, your transaction history will reflect the change and your Available to Spend will update.

Safer Credit Building is a feature that allows you to automatically pay your monthly balance with the money in your Credit Builder secured account. Turn it on, so your monthly balances are always paid on time! Learn more about how it works here.

Move My Pay is an optional Credit Builder feature that allows you to automatically move a set amount from your Spending Account to Credit Builder whenever you get paid. You can always make changes or move money between your Chime accounts at any time.

You can pay off your Credit Builder charges in 3 ways:

- Our recommendation is to turn on Safer Credit Building. When you make a purchase, the money you spent is put on hold in your secured account. Safer Credit Building uses that money to automatically pay your monthly balance. This will help you avoid late payments and outstanding balances.

- If Safer Credit Building is not turned on, Manual Payments can still be made at any time by going to Settings → Safer Credit Building → Make a Payment.

- ACH Payments can be made from any bank by using Credit Builder’s account and routing numbers. To find them, go to Settings → Safer Credit Building → Make a Payment → Paying with another bank

Credit Builder statements are available by the 28th of each month and due on the 23rd of the following month.

If you miss a payment, we’ll disable your Credit Builder card and ask you to pay your overdue balance. See “How and when do I pay off the card?” on how to make a payment.

If your balance due isn’t paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.

Where can I find more information on Credit Builder policies?

For the Credit Builder Visa Credit Card Agreement, please visit: https://www.chime.com/chime-credit-builder-visa-credit-card-agreement/

For the Credit Builder Application Disclosure and Secured Account Agreement, please visit: https://www.chime.com/chime-credit-builder-application-disclosure-and-secured-account-agreement