Structured Deposit

- Structured Deposit Illegal

- Structured Deposit Singapore

- Structured Deposit China

- Structured Deposit Accounts

- Structured Deposit Singapore Promotion

Cody deposits $9,500 in small bills. That is okay. But depositing $9,500 with the “purpose of evading the currency transaction reporting requirement' is a crime called structuring. The Internal Revenue Service reminded businesses that they must file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, when they engage in cash transactions in excess of $10,000.

Structured Deposit Illegal

Examples of businesses that may have to file Form 8300 include those that sell jewelry, furniture, boats, aircraft, or automobiles, as well as those that are pawnbrokers, attorneys, real estate brokers, insurance companies and travel agencies.

Structured Deposit Singapore

The law also requires that businesses report related transactions occurring within a 24-hour period. If the same payer makes two or more transactions totaling more than $10,000 in a 24-hour period, the business must treat the transactions as one transaction and report the payments. These laws are part of the Bank Secrecy Act, discussed below.

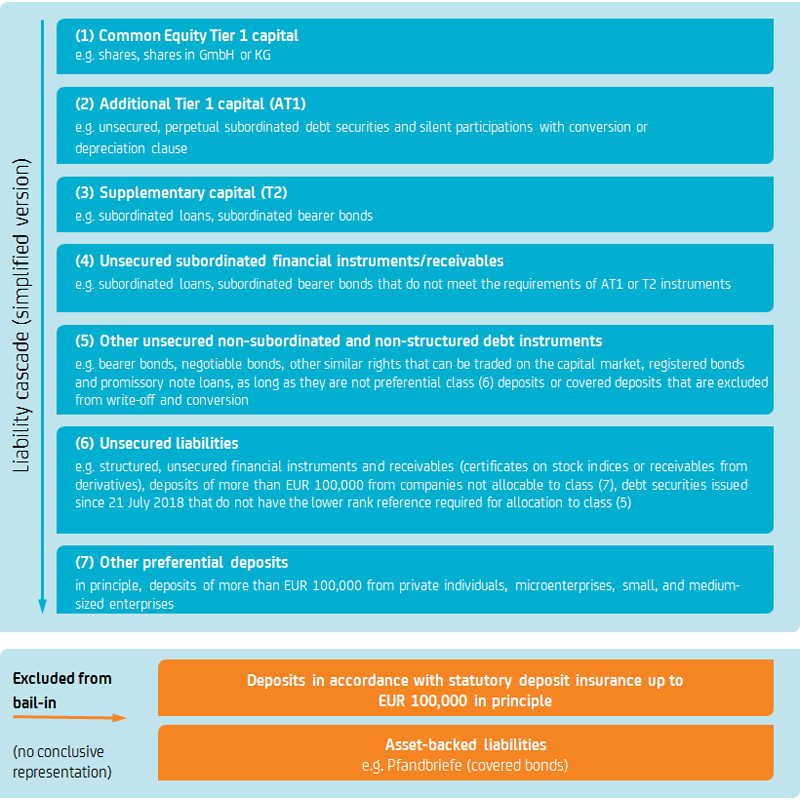

- Structured investments are typically originated and offered by investment banks and come in a variety of forms, the most common being senior unse-cured notes of the issuer. They can also come in the form of CD bank deposits, and their principal (but not unrealized gains) is insured up to applicable limits by the Federal Deposit Insurance Corp.

- A structured deposit is essentially a combination of a deposit and an investment product, where the return is dependent on the performance of some underlying financial instrument.

Structuring: Structuring transactions to evade BSA (Bank Secrecy Act) reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. Under the BSA , no person shall, for the purpose of evading the CTR (Currency Transaction Reporting) :

• Cause or attempt to cause a bank to fail to file a CTR or a report required under a geographic targeting order or to maintain a record required under BSA regulations.

• Structure, as defined below, or attempt to structure or assist in structuring, any transaction with one or more banks.

Structured Deposit China

The definition of structuring states, 'a person structures a transaction if that person, acting alone, or in conjunction with, or on behalf of, other persons, conducts or attempts to conduct one or more transactions in currency in any amount, at one or more financial institutions, on one or more days, in any manner, for the purpose of evading the [CTR filing requirements].' 'In any manner' includes, but is not limited to, breaking down a single currency sum exceeding $10,000 into smaller amounts that may be conducted as a series of transactions at or less than $10,000. The transactions need not exceed the $10,000 CTR filing threshold at any one bank on any single day in order to constitute structuring.

The purpose of these laws is to limit criminal business activity conducted in cash – money laundering, drugs, criminal enterprises, etc. However, these laws can create potential problems for “law abiding” Americans, as well as hardened and white collar criminals. The IRS has seized assets (cash and bank account deposits) under suspicion of structuring. It then falls on the taxpayer to prove that the funds and deposits are legitimate. Even in the cases where taxpayers prevail, there is tremendous time and expense defending themselves.

South Mountain Creamery

Dairy farmers Randy and Karen Sowers, who who have owned South Mountain Creamery in Middletown, Md. for more than three decades had Treasury officials show up at their farm in February 2012 to question them about bank deposits under $10,000. They learned that the federal government had just seized approximately $70,000 in their bank account. The only crime they are accused of is structuring. They have since reached a settlement with the government and are required to forfeit close to $30,000. The Sowers are apparently not drug dealers – just daily farmers.

Dennis Hastert

A structured deposit that offers repayment of the full principal at maturity can be a useful alternative to savings accounts, current accounts or term deposits. Some structured notes offer strike prices—the price at which a call or put option is exercised—that are significantly below market prices; for.

Structured Deposit Accounts

As reported yesterday, Dennis Hastert (former Speaker of the House) was indicted by a grand jury on charges of structuring and lying to the FBI.

Other examples of structuring are below. As mentioned, these laws are intended to restrict the activities of criminals.

California Man Sentenced for Structuring Cash Deposits

On July 21, 2014, in Bakersfield, California, Miguel Antonio Ruiz Jaramillo was sentenced to 12 months in prison and ordered to pay $91,527 in unpaid federal taxes. According to court documents, from January 2010 through July 2012, Jaramillo cashed more than fifty checks in amounts of $10,000 or less at a bank located in Bakersfield, totaling more than $420,000. Jaramillo had the checks cashed in this manner to prevent, or attempt to prevent, the bank from filing a currency transaction report on those transactions. He did not want a report filed because for the years 2010 and 2011, he did not declare the structured cash transactions as income on his federal tax returns.

Doctor Sentenced for Tax Evasion and Currency Structuring

On April 28, 2014, in Macon Ga., Robert Sperrazza, M.D., formerly a resident of Lee County, Georgia, was sentenced to 36 months in prison and ordered to forfeit $870,238 to the United States. Sperrazza was convicted by a jury on June 7, 2013 of three counts of tax evasion and two counts of currency structuring. According to trial evidence, Sperrazza personally cashed over one million dollars in patient checks at the counter of a local bank, in Albany, Georgia. Sperrazza structured the cash transactions in amounts under $10,000 for the purpose of evading the bank reporting requirements of federal law and for the purpose of furthering his tax avoidance scheme. Sperrazza was formerly an anesthesiologist in Albany, Georgia. He later moved to Panama City Beach, Florida where he briefly operated a pain clinic. Sperrazza is not currently involved in the practice of medicine.

Man Sentenced for Making and Selling Bootlegged DVDs and CDs

On Aug. 27, 2014, in Hartford, Connecticut, John W. Rice, of Windsor, was sentenced to 18 months in prison, three years of supervised release. In addition, Rice forfeited $48,195 seized from his bank account, a 2005 Chevrolet Corvette and a 2012 BMW 650i. On April 25, 2014, Rice pleaded guilty to one count of criminal copyright infringement and one count of money laundering. According to court documents, between 2000 and 2013, doing business as “Dr. Jay’s Entertainment,” Rice manufactured copies of motion pictures, television shows, and music that were copyrighted works, using recordable blank DVDs and CDs. Rice displayed and sold the bootlegged merchandise in a variety of locations and advertised and sold the materials over the internet. A total of 8,913 DVDs and 11,410 CDs were seized from Rice and Dr. Jay’s Entertainment. Rice also structured cash deposits into his bank account. In November 2012, Rice withdrew from his account $39,237 in cash derived from his criminal activity in order to purchase a cashier’s check payable to BMW of West Springfield.

Georgia Man Sentenced for Investment Fraud Scheme

On June 25, 2014, in Peoria, Illinois, Kenneth Lewis of Augusta, Georgia and Cranford, New Jersey, was sentenced to 271 months in prison and ordered to pay $5,565,406 in restitution. Lewis was convicted of four counts of wire fraud and 11 counts of money laundering. According to court documents, beginning in the late 1990s, Lewis offered investors the ability to generate income through highly secretive overseas financial transactions. He obtained more than $5.5 million from victims to cover his living expenses while he was purportedly working on completing the details of non-existent transactions. Lewis told investors that he had been living in Zurich, Switzerland for seven years working on the transaction, when, in fact, he was living in a hotel in New Jersey, where he was arrested in July 2012.

How to Avoid Structuring?

Structured Deposit Singapore Promotion

Certainly one of the best ways is to simply not do it. For those that have a cash business, it is important to build a relatiohship with the bank so the bank understands that the daily deposits (under $10,000) is not structuring, but rather normal operations. It is more than a little frightening to think that a teller who does not know you can create serious problems when you are really just conducting a legitimate business.