Uob Cheque Deposit

Uob Cheque Deposit

(effective from 1 August 2019 for all account openings and updating of signatories processed at UOB Branches). S$0.75 per cheque: Stop Cheque SGD Deposit Accounts & Global Currency Accounts; S$30 per cheque: Returned Cheque due to Insufficient Funds or Post-Dated. Transfer to UOB Account (in unlike currencies) Transfer to Other Bank - GIRO Transfer to Other Bank - FAST Bill Payment Cashier Order Demand Draft Telegraphic Transfer Stop Cheque Request Cheque Book Request Term Deposit Placement All Products All Products 24/7 9.30 am - 9.30 pm 9.30 am - 9.30 pm 9.30 am - 7.00 pm 9.30 am - 4.00 pm 9.30 am - 12. Locate the nearest UOB branch, Privilege Banking Centre, Privilege Reserve Suite or Wealth Banking Centre. Or get your banking done through any of our self-service banking machines, from ATMs to cash/cheque deposit machines.

Uob Cheque Deposit Location Singapore

Uob Cheque Deposit Plaza Singapura

Uob Cheque Deposit Time

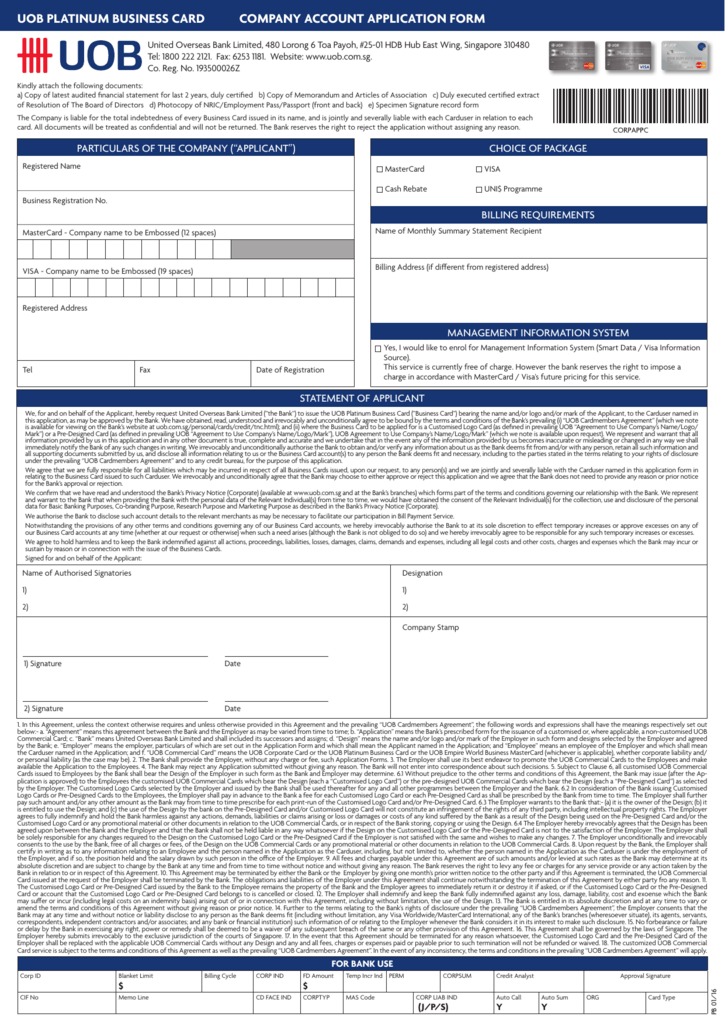

| GENERAL SERVICES | |||||||||||||||||||

| SGD CURRENT ACCOUNT | |||||||||||||||||||

| Minimum Initial Deposit | S$1,000 | ||||||||||||||||||

| Minimum Balance Fee (per month) | S$35 if the average daily balance for the month falls below S$10,000 | ||||||||||||||||||

| Account Closure Fee for account closed within 6 months of account opening | S$30 | ||||||||||||||||||

| Account Setup Fee (applicable to foreign incorporated companies only) | S$500 minimum | ||||||||||||||||||

| Branch Processing Fee(s) (effective from 1 August 2019 for all account openings and updating of signatories processed at UOB Branches) | For corporate structures1 that consist of multi-layers of shareholdings with shareholders who are foreign entities, a fee of S$1000 is applicable for each layer of delayering. [1.Processing fee(s) is charged on top of Account Setup Fee applicable to foreign incorporated companies] | ||||||||||||||||||

| Annual Account Fee | S$35 (w.e.f. 1 January 2020) | ||||||||||||||||||

| Over-the-counter (OTC) transaction fee |

| ||||||||||||||||||

| Incidental Overdraft Charge (per month) for deposit accounts without credit limit | Prime + 4% payable on overdrawn amount* [*Subject to minimum S$10 per month for Singapore Dollar Deposit Accounts] | ||||||||||||||||||

| FOREIGN CURRENCY DEPOSIT ACCOUNTS | |||||||||||||||||||

| Account Setup Fee (applicable to foreign incorporated companies only) | S$500 minimum | ||||||||||||||||||

| Branch Processing Fee(s) (effective from 1 August 2019 for all account openings and updating of signatories processed at UOB Branches) | For corporate structures1 that consist of multi-layers of shareholdings with shareholders who are foreign entities, a fee of S$1000 is applicable for each layer of delayering. [1.Processing fee(s) is charged on top of Account Setup Fee applicable to foreign incorporated companies] | ||||||||||||||||||

| Minimum Initial Deposit |

| ||||||||||||||||||

| Minimum Average Daily Balance |

| ||||||||||||||||||

| Minimum Balance Fee (per month) if Average Daily Balance falls below Minimum Average Daily Balance |

| ||||||||||||||||||

| Monthly Service Fee |

| ||||||||||||||||||

| Incidental Overdraft Charge (per month) for deposit accounts without credit limit | Prime + 4% payable on overdrawn amount* [*Subject to the minimum charge in the following respective currency per month:]

| ||||||||||||||||||

| Foreign Currency Notes Deposit/Withdrawal Commission-in-lieu Charges | |||||||||||||||||||

| Commission Charges | 1% of the transaction amount for like-currency deposit/withdrawal Minimum Charge:

| ||||||||||||||||||

| CASHIER'S ORDERS | |||||||||||||||||||

| Application by Account Holder | S$5 per Cashier's Order | ||||||||||||||||||

| Stop Payment | S$20 (or its equivalent) per Cashier's Order | ||||||||||||||||||

| Cancellation | S$5 per Cashier’s Order | ||||||||||||||||||

| CHEQUES | |||||||||||||||||||

Cheque Charges

| S$0.75 per cheque | ||||||||||||||||||

Stop Cheque

| S$30 per cheque | ||||||||||||||||||

Returned Cheque due to Insufficient Funds or Post-Dated

| S$40 per cheque | ||||||||||||||||||

| Cheque / Voucher Retrieval | S$50 per copy | ||||||||||||||||||

Marked Cheque

| S$100 per cheque | ||||||||||||||||||

| INTERBANK TRANSFERS VIA GIRO IN S$ | |||||||||||||||||||

Via Business Internet Banking

|

| ||||||||||||||||||

Via Manual Form

|

| ||||||||||||||||||

Via Manual Form

|

| ||||||||||||||||||

| INTERBANK TRANSFERS VIA FAST IN S$ | |||||||||||||||||||

Via Business Internet Banking

|

| ||||||||||||||||||

Via Manual Form

|

| ||||||||||||||||||

Via Manual Form

|

| ||||||||||||||||||

| PAYNOW TRANSFERS IN S$ | |||||||||||||||||||

FAST via Business Internet Banking

|

| ||||||||||||||||||

GIRO via Business Internet Banking

|

| ||||||||||||||||||

| Registration via Business Internet Banking | Waived | ||||||||||||||||||

| Registration via Manual form | Waived | ||||||||||||||||||

| Incoming PayNow Transactions |

| ||||||||||||||||||

| INTER-ACCOUNT FUNDS TRANSFER | |||||||||||||||||||

| Via Business Internet Banking | Waived | ||||||||||||||||||

At the branch (over-the-counter)

|

| ||||||||||||||||||

| ATM FEES | |||||||||||||||||||

| Replacement of ATM Card | S$5 | ||||||||||||||||||

| Cash withdrawal on UOB ATMs in Singapore | Free | ||||||||||||||||||

| Cash withdrawal on shared ATM NETS | 2 free transactions per month; S$0.30 per transaction for subsequent transactions | ||||||||||||||||||

| CashCard statement printing (For last 10 transactions) | S$0.20 per statement (deducted from CashCard) | ||||||||||||||||||

| SAFE DEPOSIT BOX SERVICE | |||||||||||||||||||

| Key deposit | S$100 (Refundable upon return of keys) | ||||||||||||||||||

| Lost key charges | |||||||||||||||||||

| Loss of 1 key | S$100 (excluding GST) | ||||||||||||||||||

| Loss of 2 keys | S$250 (excluding GST) | ||||||||||||||||||

| For more information on rental charges and availability of our Safe Deposit Boxes, please call our Customer Service Hotline: 1800 226 6121 (9am to 6pm, toll-free). | |||||||||||||||||||

| OTHER SERVICES | |||||||||||||||||||

| Audit Confirmation | S$50 per request (revised with effect from 1 April 2014) | ||||||||||||||||||

| Statement Retrieval Charges | All Statements

| ||||||||||||||||||